salt tax deduction calculator

This significantly increases the boundary that put a cap on the SALT deduction at 10000 with the Tax Cuts and Jobs Act of 2017. The 2022 tax values can be used for 1040-ES estimation planning ahead or.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

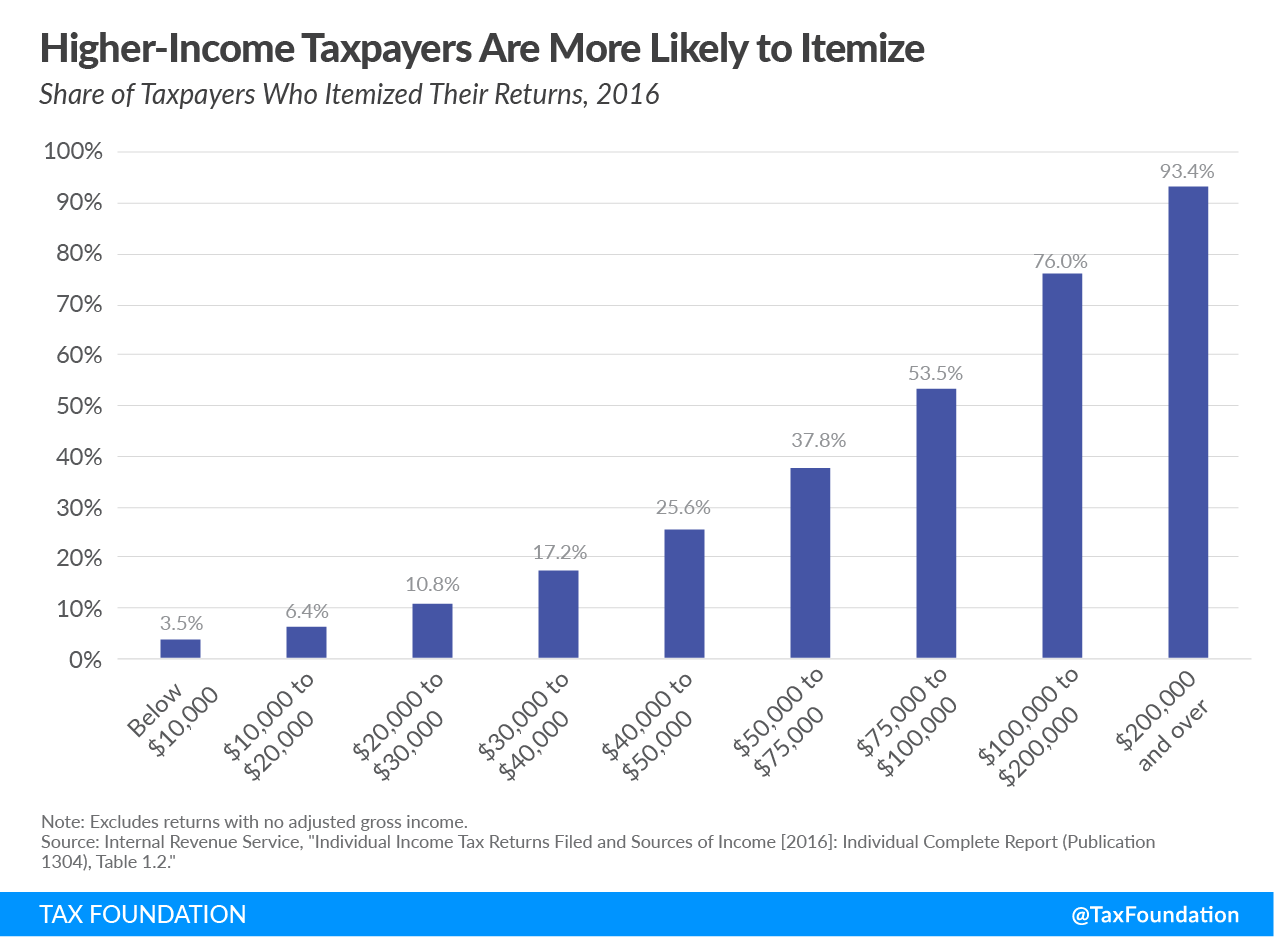

. The SALT deduction cap was introduced as part of the Tax Cuts and Jobs Act as a means to broaden the individual income tax base and partially fund reductions in statutory tax rates including a reduction in the top rate. In 2016 taxpayers with AGIs between 0 and 24999 claimed in. The unlimited SALT deduction allowed millions of Americans to use state and local tax bills to reduce federal taxes on a dollar-for-dollar basis.

Prior to the TCJA there were no restrictions on SALT deductions but beginning in 2018 taxpayers deductions were capped at 10000. A Democratic proposal aims to restore the SALT deduction for taxpayers who make less than 400000 a year and increase the deduction cap for Americans who make up to 1 million. Though there is a controversy behind this change as the average SALT tax paid isnt even one-tenth.

Before the creation of a cap on this deduction 91 of the benefit of the SALT deduction. The Maryland total deduction starts with the 10000 allowed on the federal return. If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize.

Repealing the SALT deduction cap and raising the top tax rate to 396 percent would reduce federal revenue by 532 billion over the next 10 years. If you dont itemize and instead claim the standard deduction which is 12200 for 2019 and 12400 for 2020 you cant claim any of the state and local tax deductions. It is mainly intended for residents of the US.

IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the state and local tax SALT deduction is in effect. The value of the SALT deduction as a percentage of adjusted gross income AGI increases with a taxpayers income. The Supporting Americans with Lower Taxes SALT Act sponsored by US.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The taxes that can be. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

Using Schedule A is commonly referred to as itemizing deductions. Beginning in 2017 SALT deductions. Like other individual tax provisions in the TCJA it expires at the end of 2025.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. This means that in 2026 the SALT deduction once.

The SALT deduction applies to property sales or income taxes already paid to state and local governments. In 2016 77 percent of the benefit of the SALT deduction accrued to those with incomes above 100000. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. Ad Find Deals on turbo tax online in Software on Amazon. The state and local tax deduction is claimed on lines 5-7 on Schedule A when you file your Form 1040.

The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. Starting with the 2018 tax year the maximum SALT deduction available was 10000. New limits for SALT tax write off.

3800 of this is treated as the full amount of the real estate tax paid and. If the state income tax withheld is 7600 and the property tax paid is 3800 for a total of 11400 paid the deduction for state and local taxes SALT for federal taxes is 10000. 52 rows The SALT deduction is only available if you itemize your deductions.

And is based on the tax brackets of 2021 and 2022. Only 66 percent went to taxpayers with incomes below 50000. Income taxes or sales taxes.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Fortunately this limitation is only temporary. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Itemized Deduction Who Benefits From Itemized Deductions

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Are Itemized Deductions And Who Claims Them Tax Policy Center

State And Local Tax Salt Deduction Salt Deduction Taxedu

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

If You Are Running A Company Or If You Are Working As An Accounting You Will Be Familiar With The Meaning Of Cost Of Goods Sold Cost Of Goods Excel Templates

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center